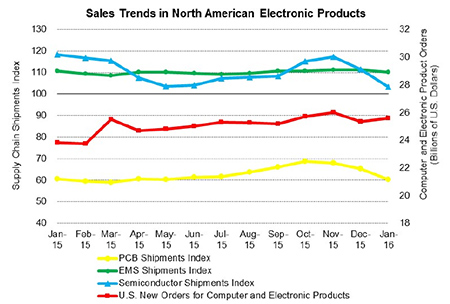

The three-month rolling averages of North American printed circuit board (PCB) and semiconductor sales continued their decline in January 2016, as electronics manufacturing services (EMS) sales remained flat. U.S. new orders for electronic equipment ticked up slightly in January after a dip in December reflecting the slowdown in the fourth quarter of 2015.

U.S. new orders for electronic products tend to lead sales by one to two months. Another leading indicator is IPC’s PCB book-to-bill ratio, which normally leads sales by three to six months. Ratios were positive in the first 10 months of 2015, but slumped in the fourth quarter. The January 2016 ratio bounced back to 1.04. This leading indicator predicted the PCB sales slowdown in late 2015 and early 2016. Ratios above parity (1.00) indicate greater demand than supply, which may be a precursor of positive sales growth for electronics manufacturers.

All data cited in this report are based on rolling averages of the past three months, which irons out some of the volatility in monthly data to show clearer trends.

Note on the graph: All indices are based on the same baseline of the average month in 2000=100, and reflect a three-month rolling average.

Sources: IPC statistical programs for the EMS and PCB industries; SIA for semiconductor data; U.S. Census Bureau for U.S. new orders for computer and electronic products.

Download the graph as a PDF

Market Research Reports

World Market Size Estimates

| Billions of U.S. Dollars | For Year | Source |

| Printed Circuit Boards (PCBs) | $60.2 | 2014 | IPC, World PCB Production Report for the Year 2014 |

| Electronics Manufacturing Services (EMS) | $436.0 | 2014 | New Venture Research, The Worldwide EMS Market, 2015 edition |

| Electronic Equipment (Final Assembly) | $2,049 | 2014 | Custer Consulting Group and Electronic Outlook Corp. |

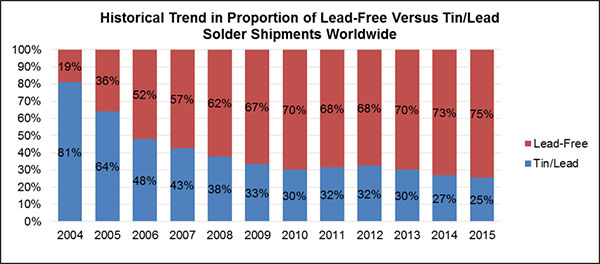

Lead-Free Trends

Source: IPC Global Solder Statistical Program